Perhaps you’re working full-time and the idea of a more flexible work schedule sounds like the perfect antidote to your corporate routine. Or maybe, as a freelancer, you’ve struggled to find paying gigs and a steady paycheck would be a welcome relief. Whatever your situation, reviewing both options can help. I’ve been through this analysis in my own career and here’s a few things I learned along the way.1

Tax impact

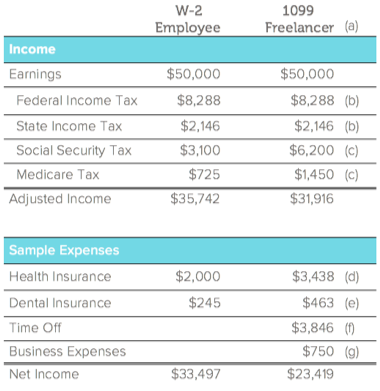

When I left my full-time job to go independent, the idea of making a much higher hourly rate as a consultant sounded pretty sweet. Then tax season came around and I found out that independent contractors (those getting paid on a 1099 basis2) actually pay higher taxes than employees who get a W-2 at the end of the year. If you are a 1099 worker, not only will you have to pay personal income tax, but you will pay double the Social Security and Medicare taxes over what your fully employed friends pay (a portion of this extra tax is deductible on your annual return). As an independent 1099 contractor, you are both the employee and the employer and have the privilege of paying both portions. For a side by side estimate of the tax impact, see the table below.

A related tax issue is whether you prefer to pay your taxes quarterly (1099 workers need to do this) or have your taxes deducted from your pay regularly. The advantage of quarterly taxes is you have the use of the cash you would have otherwise paid in taxes for 3 months. But writing that big quarterly check can be painful, especially if you’re not good at saving.

Benefits

At most companies, the cost of employee benefits can be 25-40% of employees’ base salary. Of course not every company-paid benefit is one you’d want to pay for yourself, so consider which are essential and those that are only nice to have. The table above includes an estimate for three common benefits. As you can see, with taxes, benefits and business expenses, you do need a higher hourly rate as a freelancer than as a full-time employee to have the same financial buying power.

Medical coverage: If you are currently on a company-sponsored insurance plan and you resign, you have the option of maintaining it through COBRA3 (your company’s HR team can give you the cost for this) or you can sign up for an individual plan. State or federal insurance exchanges (via the Affordable Care Act) are a good way to estimate the cost of an individual plan.

Other insurance: Do you want dental, vision, life, or disability insurance? Each is available at a price. Disability insurance can be difficult to get unless you can show a stable stream of income.

Retirement accounts: One advantage of being a freelancer is that you may be able to save significantly more per year in a tax advantaged retirement account. There are many flavors of IRAs, Roth IRAs, and individual 401ks. It’s best to talk to a tax advisor to understand the options and the advantages they may have over an employer sponsored 401k. Of course, employer based 401ks often come with a company match which will likely be missing from your individual plan.

Time off: Paid vacation, holidays and sick time are typically not something freelancers can expect. In a few cities even clients of independent contractors need to provide paid sick time (dependent on hours worked), but in most cases freelancers have to fund their own time off.

Business expenses

As a freelancer, you’ll have to pay for a lot of things that employers typically provide like equipment, office supplies and Wi-Fi. But if you’re independent, you have the freedom to choose the business expenses you want and they’re typically tax deductible.

Finding work

Oh yeah… there’s that. When you’re independent, you have to actually build a business. This was probably the biggest sticking point for me when I went out on my own. I loved doing the work and I was good at it. But potential clients couldn’t always find me and often didn’t realize what I could do for them. It’s hard work to figure out a marketing strategy and to sell yourself and your capabilities… something that would cause me to break out in a cold sweat if I thought too much about it. Independent contractors I’ve spoken with said that they spend 30-50% of their time networking and marketing. This challenge of finding work is why staffing firms like Creative Circle have so many talented freelancers on our roster.

And word to the wise, if you’re getting paid by the project and not by the hour, it’s easy to underestimate how long a project will take to complete. I was always tweaking and improving upon my work. Great for the client. Not so great for my bottom line. If you’re getting paid by the project, the fee you negotiate is typically the fee you get regardless of how much time it takes.

Being part of a team

The other aspect of being independent that I sometimes found difficult is that I would often go for several days without seeing anyone I worked with. For some, this might be a blessing, but I enjoy being part of a team. Yes, I’d often go into client offices and sometimes even work out of them for several weeks at a time. But even then you’re usually viewed as being an outsider. And often I’d be at home, working by myself and communicating remotely. If working with others is important to you, then being an internal employee may be more attractive. And if you’re a freelancer with a social mindset, look for longer term projects that include working in client offices or on client teams.

Flexibility

I saved the best benefit of being freelance for last. Yes, it is great to roll out of bed and begin work in your jammies while waking up to your first cup of morning coffee. It’s also awesome to take as many days off as you want (unpaid though they may be) and it’s incredibly satisfying to take an afternoon off to go on a hike only to come home and pick up where you left off because you feel so inspired. When you’re independent, you can work when you want, often where you want, and in the way you want. There can be more time for hobbies, family, fitness, travel or starting the next great American novel. Understandably, this is the main draw of going freelance.

The bottom line

Freedom vs. stability, independence vs. team affiliation, paid benefits vs. personal control… these are all options that will weigh differently for everyone. And no choice is forever. Your needs, interests and goals will change over time. Fortunately, with today’s technology, economy and workplace realities, opportunities to move between full-time and freelance can be fairly seamless, provided the work and jobs are available. Employers, especially those within the creative, digital, and marketing worlds, are generally understanding about candidates who make these transitions (unless they happen too frequently). And working on multiple independent assignments can strengthen your portfolio or resume by giving you a greater variety of projects to work on then you would typically get working for only one employer. This can help you land even better full-time jobs in the future.

—

[1]The information in this article focuses on a clear 1099 vs W-2 choice. Individuals who work through staffing firms (including Creative Circle) often have a blend of both worlds, being a W-2 employee of the staffing agency for the work they do through them and a 1099 employee for any independent work they do for their own clients.

[2] 1099 and W-2 are the terms used by the IRS to describe the forms you receive at the end of each tax year that companies use to report what they paid you. If you’re an employee, they send you a W-2 form and if you’re an independent contractor, they send you a 1099 form.

[3] COBRA is a law that allows you to keep your company’s medical insurance active after leaving their employment. You will need to pay for both the employer and employee portion of the insurance and it can be quite expensive. You can only keep this COBRA plan for a period of time however (typically 18 months), after which you’ll need to buy an individual plan.

[4] The footnotes below correspond to the letters notated in the ‘Tax impact’ table.

(a) Estimates based on 30-year-old single person (0 dependents).

(b) Estimated taxes are based on a Single and 1 filing status. State taxes are based on CA rates and will vary state to state.

(c) SS tax for W-2 = 6.2% of wages ($118.5k income cap). Medicare tax for W-2 = 1.45% (no cap).

1099 workers pay double (12.4% and 2.9% respectively). A portion for 1099 workers is tax deductible.

(d) 1099: silver plan (CA exchange) w/ $2,250 deductible; W-2: avg employee contribution for gold/platinum plan (per broker).

(e) 1099: lowest level of coverage (eHealth.com); W-2: avg employee contribution for common employer plan (per broker).

(f) Cost of receiving no pay for 2 weeks of vacation and 10 holidays.

(g) Estimate of business expenses (i.e. office supplies, dues, entertainment, travel) – these expenses are tax deductible.

Robin Elledge is Creative Circle’s Chief Administrative Officer. She directs the teams in Human Resources, Training/OD, Real Estate/Facilities and Internal Recruiting.

Good read! There goes my backup plan! lol